bitcoindonateur.site

Community

Best Reits For Dividend Income

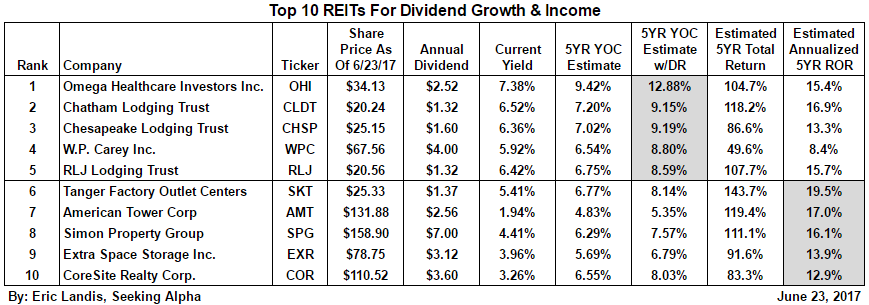

Kansas City is large distribution and logistical market that is perfect for Plymouth's portfolio. Plymouth pays a dividend yield of % right now. We should. FY 24 Projected Distribution split (%) ; Distribution till date, , , , ; (-) Dividend income, , , , Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. Our research team runs the industry's toughest dividend screening test and only picks from the top 5%. For example, they do not pay corporate income taxes, return of capital distributions are tax-deferred and REIT investors can deduct 20% of their dividends. 1. Realty Income Corporation {% dividend O %} · 2. Chatham Lodging Trust {% dividend CLDT %} · 3. EPR Properties {% dividend EPR %} · 4. LTC Properties Inc. {%. Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. REITs provide yield in the form of dividends. As noted earlier, REITs are required to distribute at least 90 percent of their taxable income to shareholders. Kansas City is large distribution and logistical market that is perfect for Plymouth's portfolio. Plymouth pays a dividend yield of % right now. We should. FY 24 Projected Distribution split (%) ; Distribution till date, , , , ; (-) Dividend income, , , , Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. Our research team runs the industry's toughest dividend screening test and only picks from the top 5%. For example, they do not pay corporate income taxes, return of capital distributions are tax-deferred and REIT investors can deduct 20% of their dividends. 1. Realty Income Corporation {% dividend O %} · 2. Chatham Lodging Trust {% dividend CLDT %} · 3. EPR Properties {% dividend EPR %} · 4. LTC Properties Inc. {%. Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. REITs provide yield in the form of dividends. As noted earlier, REITs are required to distribute at least 90 percent of their taxable income to shareholders.

Some of the largest REITs on the current market include Simon Property Group, Inc. (NYSE: SPG) and Equity Residential (NYSE: EQR). Why not invest in REITs? Get a steady 8% per year even in a zero interest rate world - featuring the 13 best high yield stocks, REITs, MLPs and CEFs for retirement income. On my buy list since April , Allied Properties REIT (bitcoindonateur.site) has moved to the top on that list for Canadian stock paying a yield of 4% or more. Typically, REITs offer investors an opportunity to possess high-priced real estate and enable them to earn dividend income to boost their capital eventually. REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors. REITs are well suited to income-oriented investors, due to their historically high and reliable dividend payouts that have generally increased over time. The Best Canadian Dividend Stocks to Buy: REITS Canada and other Top Canadian Dividend Stocks. , best canadian income trusts, canadian reits, canadian wealth. A Real Estate Investment Trust (REIT) is a security that trades like a stock on the major exchanges and owns—and in most cases operates—income-producing real. REITs are legally required to distribute at least 90% of their taxable income to shareholders annually in the form of dividends, which often results in higher. Digital Realty Trust Inc. (DLR): This is a tech-focused REIT with more than high-tech data centers globally. It offers double the dividends of the S&P. While not all high-yield REITs guarantee a % dividend, today's investors can build a portfolio of strong performing REITs with supplement income with very. 10 Best REITS to Invest in for Reliable Income in · 1. Crown Castle Inc. · 2. EPR Properties · 3. Equinix Inc. · 4. Farmland Partners Inc. · 5. Getty Realty. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37% (returning to % in ), plus a separate % surtax on. "With Realty Income's AFFO projected to be around $ based on company guidance and a forward dividend payout of about $, its dividend is. REIT is a good fit for their own investment objectives. At First National Investors like REITs for their high yield, dividend income, potential for. Find your Qualified Dividend Income Percentage for your T. Rowe Price Mutual —. U.S. Large-Cap Core, —. Value, %. Return to Top. T. Rowe Price. As a result of the dividend requirement, the dividend yield on REIT stocks 1 The top marginal tax rate on ordinary income is 37% but REITs get a REIT distributions often have different income type components with each type having a different tax rate. The best REITs to hold in a non-registered account. RIET tracks the Hoya Capital High Dividend Yield Index, a rules-based index designed to provide diversified exposure to of the highest dividend-yielding. A company that qualifies as a. REIT is allowed to deduct from its corporate taxable income all of the dividends that it pays out to its shareholders. Because of.

Suction Cup For Wood Floors

Find tile suction cups at Lowe's today. Shop tile suction cups and a variety of flooring products online at bitcoindonateur.site Laminate and Wood; LAMINATE. Resilient Flooring; AMERICAN BILTRITE · ROPPE. Accessories; CARPET AND CARPET TILE · HARDWOOD AND LAMINATE; 2Tile · VINYL AND. Suction Lifters for Raised Computer Floors. The very best way to remove panels in a raised floor environment is by using an industry-standard double suction cup. Shop Heavy Duty Glass Suction Cup Vacuum Plate Puller with Handle for Tile and Wood Floors. One of many items available from our Glass Cutters department. You should use a broom or a hardwood floor mop for daily cleaning. Try to get a wood floor vacuum for weekly cleaning. Departments · Flooring Floats. (16) · Tile Suction Cups. (2) · Tile Spacers. (1). Shop a large selection of suction cups for positioning and removing tiles at bitcoindonateur.site! Smooth, clean wood surface. Moisten cup, firmly press for secure suction adhesion on wood. Maintain pressure. Yes, there are suction cups on the underside of the individual panel sections. These suction cups provide good (but not excellent) grip to wooden floors. Find tile suction cups at Lowe's today. Shop tile suction cups and a variety of flooring products online at bitcoindonateur.site Laminate and Wood; LAMINATE. Resilient Flooring; AMERICAN BILTRITE · ROPPE. Accessories; CARPET AND CARPET TILE · HARDWOOD AND LAMINATE; 2Tile · VINYL AND. Suction Lifters for Raised Computer Floors. The very best way to remove panels in a raised floor environment is by using an industry-standard double suction cup. Shop Heavy Duty Glass Suction Cup Vacuum Plate Puller with Handle for Tile and Wood Floors. One of many items available from our Glass Cutters department. You should use a broom or a hardwood floor mop for daily cleaning. Try to get a wood floor vacuum for weekly cleaning. Departments · Flooring Floats. (16) · Tile Suction Cups. (2) · Tile Spacers. (1). Shop a large selection of suction cups for positioning and removing tiles at bitcoindonateur.site! Smooth, clean wood surface. Moisten cup, firmly press for secure suction adhesion on wood. Maintain pressure. Yes, there are suction cups on the underside of the individual panel sections. These suction cups provide good (but not excellent) grip to wooden floors.

The Goldblatt® Suction Cup is used for maneuvering non-porous, smooth tile, marble, granite and glass during installation. Lock and release handle cr. Floor Gap Fixer Tool For Laminate Repair Include Suction Cup Mallet Can'T Use · Just In Time Gifts N Things LLC () · % positive feedback. Vacuum Suction Cup Raised Floor Tile Lifter Tools, Find Details about Glass Table Suction Cups, Best Glass Suction Cups from Vacuum Suction Cup Raised Floor. Suction Cups & Material Handlers Logo Suction Cups & Material Handlers For engineered wood floors up to 5" wide and ½ inch thick; Easy to trowel; great. You can use a suction cup glass carrier, attach it to the plank, and use a rubber mallet to move the plank and close the gap. Make sure you move. My PowerEdge® Hard Floor Stick Vacuum has no suction | Support. Unplug machine Empty dirt cup Confirm the dirt cup is installed correctly There should be no. Home Vacuum Technology for Automation Vacuum Components Vacuum Suction Cups Suction Cups for Handling Wood. Suction Cups for Handling Wood. Wood Floor Gap Filler,Seam Sealant for Hardwood Floors. A Glass Suction Cup Heavy Duty ABS Vacuum Plate Puller with Handle for Ceramic Tile Wooden. FCHO Floor Gap Fixer Tool for Laminate Floor Gap Repair Include Suction Cup and Mallet (Can't use on Scraped Surface Floor) wood glue, caulking, or a shim to. Two battery Grabo Portable Electric Vacuum Suction Cup Lifter Wood Dry-Wall Granit Glass Tiles Glass Lifter. Free shipping · Multifunction Hand Tool Glass. Rubber suction cup. Suitable for removing the tops of the reservations for the Taraflex System. Technical description: World Leader Floor covering solutions. Engineered wood floors are common, so why does Steller only make Solid Wood Floors Just pull out your handy suction cup to hide a damaged plank in a low. Get free shipping on qualified Flooring Jacks products or Buy Online Pick Up in Store today in the Flooring Department. M posts. Discover videos related to Pop in Wood Flooring Suction Cup on TikTok. See more videos about Turned Wood Cup, Soda Blasting Wood Furniture with. How do I create a suction cup that sticks to the wooden floor? You don't. The issue is sealing the/a suction cup. two issues: 1) Is the wood. Plank Grabber is the quintessential tool for wood and laminate flooring. Engineered with cutting-edge Nano-Suction technology, it revolutionises the way you. Attach: Firmly press the suction cup of the Floor Gap Fixer against the plank closest to the gap. Check that it's securely attached to prevent it from slipping. All-Vac Industries is one of the premier manufacturer and distributor of vacuum cups, suction cups, vacuum lifter, hand tools, and suction cup hand tools. Floors, and it would have been devastating on any other new floor. "But here we were with a Steller Floor! So, we pulled out our handy suction cup, popped. Glue-down carpets, hardwood floors, and engineered hardwood floors require a layer of adhesive. Suction cups, replacement blades, tile nippers, tile leveling.

Capital One Secured Mastercard Annual Fee

Capital One Quicksilver Secured has a $0 annual fee and rewards cardholders with - 5% cash back on purchases. You will have to put down a $+ security. It has no annual fees and you can increase your credit limit. Consider your financial situation before deciding if the card's credit-building capabilities can. $0 annual fee and no foreign transaction fee. Lower minimum security deposit than other cards. Cons. It also has one other major advantage over most cards geared to consumers with low credit scores: It doesn't charge an annual fee. The main downside to this. Annual Fee. $0 ; Security Deposit. $49, $99 or $ minimum refundable deposit ; Purchase Rate. % variable APR. Capital One® Aspire Cash™ Platinum Mastercard ; Annual Fee. Primary card $0; Additional card ; Annual Income Required. Individual $0; Household ; Interest Rates. It has a $0 annual fee and $0 foreign transaction fees (rates & fees) but it lacks rewards. The major benefit this Capital One card offers is its card. In addition to not charging an annual fee, the card offers a rewards rate that competes with some of the top cash-back credit cards on the market. It also doesn. No annual fee · $49, $99 or $ refundable deposit · No fee charged on purchases made outside the U.S. · Flexibility to change your payment due date. Capital One Quicksilver Secured has a $0 annual fee and rewards cardholders with - 5% cash back on purchases. You will have to put down a $+ security. It has no annual fees and you can increase your credit limit. Consider your financial situation before deciding if the card's credit-building capabilities can. $0 annual fee and no foreign transaction fee. Lower minimum security deposit than other cards. Cons. It also has one other major advantage over most cards geared to consumers with low credit scores: It doesn't charge an annual fee. The main downside to this. Annual Fee. $0 ; Security Deposit. $49, $99 or $ minimum refundable deposit ; Purchase Rate. % variable APR. Capital One® Aspire Cash™ Platinum Mastercard ; Annual Fee. Primary card $0; Additional card ; Annual Income Required. Individual $0; Household ; Interest Rates. It has a $0 annual fee and $0 foreign transaction fees (rates & fees) but it lacks rewards. The major benefit this Capital One card offers is its card. In addition to not charging an annual fee, the card offers a rewards rate that competes with some of the top cash-back credit cards on the market. It also doesn. No annual fee · $49, $99 or $ refundable deposit · No fee charged on purchases made outside the U.S. · Flexibility to change your payment due date.

The Capital One Platinum Secured (see Rates & Fees) deposit requirement is $49, $99 or $ You will find out the exact deposit amount you're required to put. Platinum Mastercard® from Capital One · Get the credit you need with no annual fee. · Explore Capital One credit card benefits · Want to see more cards that could. No annual fee: There's no annual fee, so you can use this credit card without worrying about an up-front annual cost. High APR: The interest rates on the. This card comes with an annual fee of $29, other cards are available with no annual fee (either waived for the first year or free every year). [Read: Secured. Min. deposit. $49, $99 or $ ; Regular purchase APR. % (Variable) ; Annual fee. $0. Annual Fee. $0. Security Deposit. $ refundable minimum deposit. Purchase Rate. % variable APR. Tools to help you along your credit building journey. This secured card offers a decent % return rate on general purchases, making it a solid, simple option for cardholders; it also has no annual fee. However. Capital One Quicksilver Secured Cash Rewards Credit Card · No annual or hidden fees, and you can earn unlimited % cash back on every purchase, every day. · Put. No annual or hidden fees. See if you're approved in seconds · Building your credit? Using the Capital One Platinum Secured card responsibly could help · Put down. Min. deposit. $49, $99 or $ Refundable · Regular purchase APR. % (Variable) · Annual fee. $0. Get the credit you need with no annual fee. Annual Fee. $0. Purchase Rate. % variable APR. Transfer Info. No annual or hidden fees. · Building your credit? · Put down a refundable security deposit starting at $49 to get a $ initial credit line · You could earn back. With many secured card issuers, you need to request a credit limit increase or make a larger security deposit to get a higher credit limit. High interest rate. No annual or hidden fees. · Building your credit? · Put down a refundable security deposit starting at $49 to get a $ initial credit line · You could earn back. This card now comes with no annual fee, making it one of the few secured cards without it. The Capital One Secured MasterCard is a nice alternative for. This card now comes with no annual fee, making it one of the few secured cards without it. The Capital One Secured MasterCard is a nice alternative for. Card type: Secured. Annual fee: $0. Security deposit: A minimum refundable deposit of $ is required. Your deposit will determine your credit line. You may be able to secure the minimum $ credit line with a deposit of $99 or even $ Did we mention that there is NO annual fee? Capital One Secured Credit. Get the credit you need with no annual fee. Earn unlimited 2 miles per dollar on every purchase, plus 5 miles per dollar on hotels, vacation rentals, and. Build credit or repair bad credit with a Guaranteed Mastercard. Capital One has been helping Canadians build credit for more than 20 years – apply online.

Building Personal Wealth

For those looking to invest beyond retirement, consider opening a brokerage account to invest in individual funds, stocks, bonds or other riskier financial. With more than 2, personal finance blogs dedicated to money and investing that reach millions of readers each week, how do you find the perfect finance blogs. 1. Understand net worth · 2. Set financial goals · 3. Earn income · 4. Save money automatically · 5. Spend money consciously · 6. Pay off high-interest debt · 7. Accumulating and growing your net worth is a critical component of a successful financial plan and is essential for creating a financially free life you love. Create a Plan to Accumulate Wealth. The first step to building wealth is earning enough money to save and invest in your future while covering your basic. Quick Take: How To Build Wealth · Determine your net worth to establish your starting point. · Set short-term and long-term financial goals. · Earn additional. First-generation Americans need to start building wealth — here's how they can do it · 1. Start building an emergency fund · 2. Open up a Roth IRA to start. Start building wealth in 12 steps · 1. Educate yourself about money · 2. Identify your goals · 3. Make a budget and keep it · 4. Establish an emergency fund · 5. A Beginner's Guide to Securing Your Financial Future Building Wealth is a personal finance education resource that presents an overview of wealth-building. For those looking to invest beyond retirement, consider opening a brokerage account to invest in individual funds, stocks, bonds or other riskier financial. With more than 2, personal finance blogs dedicated to money and investing that reach millions of readers each week, how do you find the perfect finance blogs. 1. Understand net worth · 2. Set financial goals · 3. Earn income · 4. Save money automatically · 5. Spend money consciously · 6. Pay off high-interest debt · 7. Accumulating and growing your net worth is a critical component of a successful financial plan and is essential for creating a financially free life you love. Create a Plan to Accumulate Wealth. The first step to building wealth is earning enough money to save and invest in your future while covering your basic. Quick Take: How To Build Wealth · Determine your net worth to establish your starting point. · Set short-term and long-term financial goals. · Earn additional. First-generation Americans need to start building wealth — here's how they can do it · 1. Start building an emergency fund · 2. Open up a Roth IRA to start. Start building wealth in 12 steps · 1. Educate yourself about money · 2. Identify your goals · 3. Make a budget and keep it · 4. Establish an emergency fund · 5. A Beginner's Guide to Securing Your Financial Future Building Wealth is a personal finance education resource that presents an overview of wealth-building.

Before someone can truly begin building wealth, they must consistently generate enough income to handle month-to-month expenses. It's also a good idea to have. You don't need to become a financial genius, but it's important to understand how things like compound interest works, why home equity contributes to your net. Building Wealth: Achieving Personal and Financial Success in Real Estate and Business Without Money, Credit, or Luck [Whitney, Russ] on bitcoindonateur.site In this eye-opening book, the author shares his personal experiences and lessons learned from his two fathers - one rich and one poor. Through their contrasting. The best money managers don't put all their eggs in one basket. When you begin to develop wealth, you should strive for diversity in your investments. Growth: When you have financial freedom, you also have more time to pursue personal freedom. The wealth in your external world becomes a mirror to the wealth in. What It Means to Build Wealth · Set Goals: Building wealth requires the individual to set realistic goals. · Earn Money: As obvious as it sounds, earning money is. Building Wealth: Achieving Personal and Financial Success in Real Estate and Business Without Money, Credit, or Luck [Whitney, Russ] on bitcoindonateur.site Growing personal wealth involves the use of qualified retirement plans, estate planning and philanthropy. Read more. Read less. Regardless of your stage in. How to Build Wealth Beyond Money · Focusing on Meaningful Relationships · Investing in Education and Growth · Having an Abundance Mindset and Lifestyle · Bringing. 12 Wealth Building Habits to Grow Your Net Worth in · 1. Set a Budget — And Don't Override It · 2. Avoid Lifestyle Creep · 3. Look for Tax Savings · 4. Pay. For example, assets with income or appreciation potential may help build your net worth. Examples include: bank certificate of deposits, treasury notes and. At the end of the day, it is not how much you make that matters, but how you spend, save, and invest the money you make. Building wealth is not so hard after. Here are some ways to build wealth and plan for your future: Find active and passive sources of income, stick to a budget, and invest consistently for the long. Set yourself up to earn more · Avoid credit card debt at all costs · Identify your financial goals · Pay your future self · Start investing early and often · Think. Top 10 Simple Principles for Building Your Wealth · 1. Never Spend More Than What You Earn · 2. Understand Your Motivation For Wealth Creation · 3. Make your Money. Wealth Building Step 1: Spend Less Than You Make & Invest the Difference The first sentence summarizes how to manage your personal finances so that you grow. Create a budget that reduces financial waste. · Lower the interest rates on existing debt. · Add to your income sources, so you have more money to save and invest. A Beginner's Guide to Building Wealth · Set yourself up to earn more · Avoid credit card debt at all costs · Identify your financial goals · Pay your future self. Achieving financial security as a small business requires intentional planning. At the most basic level, wealth building involves taking your sustainable.

How To Calculate Principal And Interest On A Loan

The function that calculates the interest and principal components of any single payment on your BAII Plus calculator is called AMORT. It is located on the 2nd. Principal & Interest Payment Calculator. This calculator will help you to determine the principal and interest breakdown on any given debt payment. Enter the. In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is. Next, the schedule shows how much of the payment is applied to interest and how much is applied to the principal over the duration of the loan. In the last. You can calculate interest paid on a mortgage loan using the interest rate, principal value (property price), and the terms of the loan (the duration and. Next take the mortgage principal and multiply it by one twelfth of the stated interest rate. That is the interest portion of the monthly payment. To find the principal, divide the amount of interest by the product of the interest rate and the time of the loan in years. What is the difference between the. Also included are optional fields for taxes, insurance, PMI, and association dues. Mortgage loan amount: Mortgage interest rate (%): Mortgage loan term (# years). It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that. The function that calculates the interest and principal components of any single payment on your BAII Plus calculator is called AMORT. It is located on the 2nd. Principal & Interest Payment Calculator. This calculator will help you to determine the principal and interest breakdown on any given debt payment. Enter the. In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is. Next, the schedule shows how much of the payment is applied to interest and how much is applied to the principal over the duration of the loan. In the last. You can calculate interest paid on a mortgage loan using the interest rate, principal value (property price), and the terms of the loan (the duration and. Next take the mortgage principal and multiply it by one twelfth of the stated interest rate. That is the interest portion of the monthly payment. To find the principal, divide the amount of interest by the product of the interest rate and the time of the loan in years. What is the difference between the. Also included are optional fields for taxes, insurance, PMI, and association dues. Mortgage loan amount: Mortgage interest rate (%): Mortgage loan term (# years). It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that.

Simple interest formula. Here is the mathematical formula, on which a simple interest calculator works to compute the loan amount: · A = P (1+RT). To calculate. Interest Rate is the APR from the loan rate chart. · # of Payments is the number of monthly payments you will make to pay off the loan. · Principal is the amount. In this, "a" stands for the total loan amount, "r" for the periodic interest rate, "n" for the total number of payment periods, and "p" for the monthly payment. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and interest payment (PI). Loan origination percent: The percent of. click to expand contents The Principal and Interest Calculator provides a schedule of your monthly repayments and shows you what portion goes towards interest. = P × R × T,. Where,. P = Principal, it is the amount that initially borrowed from the bank or invested. R = Rate of Interest, it is at which. Step 2: Substitute these values into the simple interest formula, A = P(1+rt). Step 3: Solve for P, the principal. How to Find the Principal of a Simple. Next take the mortgage principal and multiply it by one twelfth of the stated interest rate. That is the interest portion of the monthly payment. This calculator will help you figure out how much you're paying toward the principal and what you're paying in interest. Original principal amount borrowed: Annual interest rate: Original loan term (# of months). Original monthly payment amount: Month and year of first payment. The formula to determine simple interest is an easy one. Just multiply the loan's principal amount by the annual interest rate by the term of the loan in years. First, convert your annual interest rate from a percentage into a decimal format by diving it by · Next, divide this number by 12 to calculate the monthly. The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a. Subtract the interest from your current debt. The amount left is what you owe towards your loan principal. · Deduct the above amount from your original principal. Formula for calculation of interest rate payments on self amortising loan (equal repayments of principal). L = loan amount r = interest rate n = tenor of the. This calculator will help you to determine the principal and interest breakdown on any given payment number. Obtain the new principal balance of your loan from your Online Banking Account Services page or the automated phone service. 2. Multiply your principal. Multiply this result by your principal to find out your monthly loan payment. For instance, you take out a $50, mortgage and receive a 5% interest rate. Your. Calculate how much of your home loan repayments form a part of your principal and interest amounts. The major variables in a mortgage calculation include loan principal, balance, periodic compound interest rate, number of payments per year, total number of.

Can I Use Food Stamps On Walmart Pickup

Massachusetts residents who receive SNAP benefits can use their EBT card to buy food Walmart, as well as ALDI, Big Y, Brothers Marketplace, Hannaford. Enjoy free same-day pickup when you order before 3pm. When you show up at your preferred location, we'll even load your car for you in minutes. Best of all. You can not. You can do OGD/P with EBT but not in store on walmart pay. Walmart: Accepts EBT payment during checkout and offers pickup service; King Soopers: Offers pickup service and EBT payment at pickup; Safeway/Albertson's. You can now use your preferred payment methods online or in the app. Shop the same deals and savings you'd find in. Georgians can now shop online with SNAP. August 05, Share. About | Contact | Statements · JWT Auth for open source projects. Participating online stores now accept SNAP benefits for online orders and will deliver to you. Use your EBT card to shop securely for fresh produce and. Walmart. You will be able to order food online that you would normally buy with your SNAP EBT card-in person and pickup curbside or select home delivery. You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana. Massachusetts residents who receive SNAP benefits can use their EBT card to buy food Walmart, as well as ALDI, Big Y, Brothers Marketplace, Hannaford. Enjoy free same-day pickup when you order before 3pm. When you show up at your preferred location, we'll even load your car for you in minutes. Best of all. You can not. You can do OGD/P with EBT but not in store on walmart pay. Walmart: Accepts EBT payment during checkout and offers pickup service; King Soopers: Offers pickup service and EBT payment at pickup; Safeway/Albertson's. You can now use your preferred payment methods online or in the app. Shop the same deals and savings you'd find in. Georgians can now shop online with SNAP. August 05, Share. About | Contact | Statements · JWT Auth for open source projects. Participating online stores now accept SNAP benefits for online orders and will deliver to you. Use your EBT card to shop securely for fresh produce and. Walmart. You will be able to order food online that you would normally buy with your SNAP EBT card-in person and pickup curbside or select home delivery. You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana.

You'll pay the same low prices you find in store. SNAP EBT customers can pay with the EBT card. Enjoy free same-day pickup when you order before 3pm. When you. Pick up your groceries and get them loaded into your car for free with Walmart Pickup. Plus, there is no basket minimum for EBT online orders. Save your EBT. Swipe EBT card with the Walmart associate upon arrival at the pick-up location. Amazon Delivery. Add your SNAP EBT card to pay for eligible groceries, including. SNAP benefits cannot be used to pay for delivery fees. Curbside pickup is available at Walmart to avoid a delivery fee. Amazon is currently offering free. Yes, you can use your SNAP EBT card to shop online for groceries and have them delivered. This is called "online purchasing" or "SNAP online.". In Mississippi, groceries can be purchased online through Walmart and Amazon using a SNAP EBT card. Shopping online is an easy and convenient way to shop for. Use EBT SNAP to buy groceries at participating stores on Instacart and skip the delivery or pickup fee. New customers get free delivery on your first 3 orders. SNAP recipients in Texas can buy food online. This will make it easier Can I use my SNAP benefits to buy groceries online at any store that offers. Walmart is one of many retailers that accepts EBT payments (in 48 states you can pay at checkout, in Alaska and Montana, you can pay at pickup) and a convenient. your EBT card from Walmart, you can pay online using your EBT card and schedule a grocery pick-up for no charge. 7. Where can I go if I have additional. can use your SNAP food benefits or P-EBT benefits to order groceries online for pickup or delivery from participating ShopRite and. Walmart stores and Amazon. Frequently Asked Questions on how to use your Supplemental Nutrition Assistance Program (SNAP) EBT to buy food online pickup, they will be able to use their. You can now use your preferred payment methods online or in the app. Shop the same deals and savings you'd find in. You can now pay for Walmart online grocery with EBT. You can also use your SNAP benefits online at Instacart, Amazon, BJ's Wholesale, Kroger, and more. Curbside pick-up using EBT o Walmart allows this. ▫ Call and ask ahead of time to make sure. o Call and check if retailers can swipe EBT cards at curbside. Illinois' initial Online SNAP EBT option launched in June including Amazon and Walmart. The Illinois Department of Human Services will continue working to. SNAP participants can buy groceries online for pickup or for free grocery delivery. Walmart allows you to buy groceries online and pickup at the store. When you buy your groceries online using your EBT card through Walmart, you can schedule a grocery pick-up at no charge. When you buy groceries online using. Customers can use their SNAP EBT benefits to purchase groceries on bitcoindonateur.site, Amazon Fresh and Whole Foods Market (available in select regions).

Student Loans With No Cosigner Required

You will not get student loans from a private company without credit and without a co-signer. This is a good lesson for you to be flexible. We'. No, realistically if you have bad credit, you will need a cosigner to possibly secure a private student loan. All private student loans for college are heavily. Ascent offers private student loans without a cosigner requirement to help college juniors and seniors pay for college even without a qualified cosigner. “Federal student loans, such as the federal Direct Stafford Loan (also known as a Direct Loan), are available without a co-signer,” says Mark Kantrowitz. Ascent scores highest among the few lenders offering private student loans that don't require credit history or a co-signer, and it serves the most schools. College students have access to federal and private student loans without a cosigner or parent cosigner, but the cosigner does not need to be your parents. Start with federal student loans: Federal student loans are the best choice for most borrowers, but this is especially true for borrowers without a co-signer. On the Edly Student Loans website, graduate and undergraduate students can apply for a loan without a cosigner and with no credit history. Edly Student Loans. Federal student loans are the best financing option without a co-signer because they typically offer lower interest rates than private student loans, as well as. You will not get student loans from a private company without credit and without a co-signer. This is a good lesson for you to be flexible. We'. No, realistically if you have bad credit, you will need a cosigner to possibly secure a private student loan. All private student loans for college are heavily. Ascent offers private student loans without a cosigner requirement to help college juniors and seniors pay for college even without a qualified cosigner. “Federal student loans, such as the federal Direct Stafford Loan (also known as a Direct Loan), are available without a co-signer,” says Mark Kantrowitz. Ascent scores highest among the few lenders offering private student loans that don't require credit history or a co-signer, and it serves the most schools. College students have access to federal and private student loans without a cosigner or parent cosigner, but the cosigner does not need to be your parents. Start with federal student loans: Federal student loans are the best choice for most borrowers, but this is especially true for borrowers without a co-signer. On the Edly Student Loans website, graduate and undergraduate students can apply for a loan without a cosigner and with no credit history. Edly Student Loans. Federal student loans are the best financing option without a co-signer because they typically offer lower interest rates than private student loans, as well as.

In order to qualify for a student loan with College Ave without a cosigner, you will need a credit score in the mids. College Ave is a great option if you. Although a cosigner is typically required by most lenders, international students attending certain colleges and universities in the U.S. and Canada are able to. 2. Meet the income and credit requirements When you take out a student loan with a co-signer, you qualify based on their credit history and financial profile. Pros & Cons of Student Loans With No Co-signer · You may qualify for less. Without a co-signer, you'll probably be offered a lower loan amount. · You'll pay more. Edly partners with FinWise Bank to offer income-based repayment loans to qualifying undergraduate and graduate students with no cosigner required. Ascent offers private student loans without a cosigner requirement to help college juniors and seniors pay for college even without a qualified cosigner. Private student loans may be available to students without credit histories, but there can be advantages to adding an approved cosigner to your student loan. Yes, you can get a student loan without a cosigner. At Funding U, all we offer are no cosigned loans with fixed rates and no fees. We keep things simple and. The only federal student loans that require a cosigner or a good credit score are PLUS Loans ·. These loans are available to graduate students and to the. If you want a private student loan with no cosigner, you need to have a good credit history, a or higher score. They want to see payments made on time for a. Federal student loans do not require a cosigner and come with several benefits not available through private lenders, including low interest rates and access to. The Partnership No-Cosigner Loan for Undergrads is for full-time student borrowers at the junior or above grade level based on completed credits. Students must. Most major student loan lenders require that you have a cosigner, or good enough credit history in order to qualify yourself. To apply for private international student loans that don't require a cosigner, you will usually need to be studying a postgraduate course or be in the final. If you need to borrow money but don't have a cosigner, you should first make sure you exhaust all of your federal financial aid options, including student loans. Federal Loans are the best options for students who do not have a cosigner as they do not require a credit history. Federal Loans also have flexible repayment. Cosigners need a minimum of three years of credit history, a credit score of and a minimum income of $35, per year. Best for no cosigner. Loan amounts. Basically, you need to prove you can pay back the loan on your own. Only the borrower can apply for cosigner release. Joanne explains. There are a number of private lenders that offer loans for international students, each with their own eligibility requirements. However, only select lenders. Since most federal student loans are not based upon the borrowers credit, but rather on the borrowers financial need, a cosigner will never be needed to qualify.

Need Help With Credit Card Debt

If you need help finding relief, call () or complete our form to speak with a certified credit counselor. Get Help Now. Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! Getting out of credit card debt can be difficult. Learn about your credit card debt relief options and where to find help to free you from your credit card. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a. The first step is to call a nonprofit credit counseling agency like InCharge Debt Solutions and talk to a certified counselor. The counselor will review your. Getting Credit · Credit Reports and Scores · Credit and Debit Cards · Managing Debt · Credit Repair and Debt Relief · Debt Collection · Related Scams · From Consumer. A debt management plan eliminates the need to juggle different payments and due dates. It can help you meet your debt obligations without worrying about late. If you're facing challenges with credit card debt and need help, talk to a certified credit counselor to discuss options for relief. Debt Amount. Select debt. This may help you avoid the need for traveler's checks or carrying a lot of cash when traveling. You will not build up debt using your debit card. Debit cards. If you need help finding relief, call () or complete our form to speak with a certified credit counselor. Get Help Now. Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! Getting out of credit card debt can be difficult. Learn about your credit card debt relief options and where to find help to free you from your credit card. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a. The first step is to call a nonprofit credit counseling agency like InCharge Debt Solutions and talk to a certified counselor. The counselor will review your. Getting Credit · Credit Reports and Scores · Credit and Debit Cards · Managing Debt · Credit Repair and Debt Relief · Debt Collection · Related Scams · From Consumer. A debt management plan eliminates the need to juggle different payments and due dates. It can help you meet your debt obligations without worrying about late. If you're facing challenges with credit card debt and need help, talk to a certified credit counselor to discuss options for relief. Debt Amount. Select debt. This may help you avoid the need for traveler's checks or carrying a lot of cash when traveling. You will not build up debt using your debit card. Debit cards.

Get Help Managing Credit Card Debt Getting into debt is often a one-person job. Getting out might require help. If you need some help, contact a nonprofit. 6. Contact credit card counseling, if needed. If you're having trouble keeping up with your minimum monthly payments, consider looking into credit counseling. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on the. “I had a lot of credit card debt that I needed to get a control of. GreenPath Financial Wellness was the best way to do it.”. Bank of America provides assistance to help customers better manage credit card debt and reduce financial stress. We also offer links to external resources. Fortunately, American Consumer Credit Counseling (ACCC) offers credit card relief programs that can help you pay off your cards and get out of debt for good. The first step to managing your credit card debt is to get the details on paper. Write down line by line each of your debts – including interest rates – as well. Credit Counseling. Calling on a professional is a great way to get advice specific to your financial situation. You can work with a credit counselor—often free. But the debt snowball can be psychologically better if you need help staying motivated. As you pay off the smallest accounts, you may get an extra boost of. Getting Credit · Credit Reports and Scores · Credit and Debit Cards · Managing Debt · Credit Repair and Debt Relief · Debt Collection · Related Scams · From Consumer. A debt management plan (or DMP) is a form of debt consolidation usually offered through a nonprofit credit counseling agency like Money Management International. Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. Try to keep your balance low. A good debt consolidation loan will pay off your credit cards all at once, rearranging your finances to pay off the loan at a lower interest rate over a longer. National Debt Relief is the first debt settlement company to be accredited by the Better Business Bureau with an A+ rating, the American Association for Debt. If you need help paying off your credit cards, the first step is to completely stop using them. It may be easier said than done, but it works. Credit cards are. Reach out to your credit card issuer directly and ask for help. Payment holidays for up to three months, deferred payments and delayed principal payments are a. Credit counselors can help you determine the best course of action. That may include debt settlement, but in a way that benefits you the most. On the other hand. How can I pay off my credit card debt? · Lower or pause your payments to see if your finances get better · Pause or lower interest and other charges on your. We understand that these are trying financial times. If you are struggling with credit card debt, we'd like to help. If you are struggling to make your monthly. National Debt Relief is the first debt settlement company to be accredited by the Better Business Bureau with an A+ rating, the American Association for Debt.

Bit Coin Value 2017

Bitcoins lowest price after its all time high in was around $3, How Much is a Share of Bitcoin. We don't really call anything in Bitcoin a "share". In the following plot I show the Tether printing events (gray vertical bars) corresponding from March to July , together with the. The closing price for Bitcoin (BTC) in was $14,, on December 31, It was up 1,% for the year. The latest price is $59, What was the price of Bitcoin in ? · Bitcoin recovered from the bear market and reached a new peak value just below $20, in late – Prices slowly climbed through to over $ by the end of the year. In , Bitcoin's price hovered around $1, until it broke $2, in. Bitcoin USD (BTC-USD) - Price History ; February , $10,, $10, ; January , $10,, $10, ; December , $14,, $14, In the year , bitcoin witnessed an unprecedented boom and managed to cross the $10, mark. It briefly reached $17, on December 12, The year. votes, comments. And 8k to 67k in 20/21? These were absolutely massive price rises, without any of the eft or institutional interest. Discover historical prices for BTC-USD stock on Yahoo Finance. View daily, weekly or monthly format back to when Bitcoin USD stock was issued. Bitcoins lowest price after its all time high in was around $3, How Much is a Share of Bitcoin. We don't really call anything in Bitcoin a "share". In the following plot I show the Tether printing events (gray vertical bars) corresponding from March to July , together with the. The closing price for Bitcoin (BTC) in was $14,, on December 31, It was up 1,% for the year. The latest price is $59, What was the price of Bitcoin in ? · Bitcoin recovered from the bear market and reached a new peak value just below $20, in late – Prices slowly climbed through to over $ by the end of the year. In , Bitcoin's price hovered around $1, until it broke $2, in. Bitcoin USD (BTC-USD) - Price History ; February , $10,, $10, ; January , $10,, $10, ; December , $14,, $14, In the year , bitcoin witnessed an unprecedented boom and managed to cross the $10, mark. It briefly reached $17, on December 12, The year. votes, comments. And 8k to 67k in 20/21? These were absolutely massive price rises, without any of the eft or institutional interest. Discover historical prices for BTC-USD stock on Yahoo Finance. View daily, weekly or monthly format back to when Bitcoin USD stock was issued.

Analyzing Bitcoin Price Dynamics: High-Frequency Data from to So, you've converted US Dollar to Bitcoin. We used International Currency Exchange Rate. We added the most popular Currencies and. April 14th, Bitcoin dropped to $, why? Does that mean if my timing was right I could have bought some for that price, or were there. A visual representation of the digital currency bitcoin. (Dan Kitwood / Getty Images). By Associated Press. Dec. 7, AM PT. Share. Share via. Bitcoin Price Table, (Yearly) ; , 13,, 12,, 1, ; , , , The closing price for Bitcoin (BTC) in was $14,, on December 31, It was up 1,% for the year. The latest price is $60, Bitcoin reaches its highest price above $71, since April's halving, following speculations that the ETH ETF could be approved. 3 months. Nevertheless, Bitcoin is a volatile asset and for holders of the cryptocurrency, it hasn't all been plain sailing. From September 14 to December 15 A visual representation of the digital currency bitcoin. (Dan Kitwood / Getty Images). By Associated Press. Dec. 7, AM PT. Share. Share via. The closing price for Bitcoin (BTC) in December was $14,, on December 31, It was up % for the month. The latest price is $59, The closing price for Bitcoin (BTC) in December was $14,, on December 31, It was up % for the month. The latest price is $59, The market was noticably different by the end of , however, with Bitcoin prices reaching roughly 59, as of August 29, after another crypto. Historical data for the Bitcoin prices - Bitcoin price history viewable in daily, weekly or monthly time intervals. Prices and value history ; 2–3 March , $1,+. Increase. Price broke above the November high of $1, and then traded above $1, ; 20 May Why it matters: It's clearly visible from this chart how price peaks coincide with very short doubling-times. For example, at the Dec peak, it had taken. Bitcoin price starts at $ and ends at $10, The investment begins at $ and ends at $1,, a % return. Comprehensive Bitcoin Price Data: Minute-by-Minute BTC/USDT Analysis () The table btc_price_bitcoindonateur.site contains over million rows of Bitcoin price. In , the pendulum swung again, as the price of bitcoin and other cryptocurrencies suddenly took off. Initial coin offerings (ICOs) and. Below are tables showing the Bitcoin price in US Dollar for each month of for. Under each table are the Open, Close, Highest, Lowest prices and Total Gain. On September 1, , Bitcoin traded at $ 5, for the first time, peaking at $ 5, 12 September , $ 2 , The price has plummeted due to the.

Bank Interest On One Million Dollars

Photo illustration of a blue calculator in the center of the image, with blue jars. See how much your money could grow based on today's top savings account. But One Million Dollars in the Bank got my wheels turning. Mike's book This book might interest the reader who is new to motivational reading and starting new. What is the Annual Interest on 1 Million Dollars? With a 5% interest CD (Certificate of Deposit), your annual interest earned on $1 million would be $50, **Bank Sweep program balances are held at one or more Program Banks and are not cash balances held by Vanguard Brokerage Services® (VBS®), earn a variable rate. A 1-year CD is currently available at rates of around %, so if you invested $1 million at that rate, you would earn $58, after 12 months. The downside of. After 10 years you'd have $13, You'd earn $3, in interest. After 20 years you'd have $18, You'd earn $8, in interest. Use. Use the Dollar Bank interest calculator to help you develop a savings plan that will meet your goals. Enter a dollar value of an investment at the outset. Input a starting year and an end year. Enter an annual interest rate and an annual rate of inflation. Click. It depends entirely on the interest rate that is paid on the million dollars. If the million dollars earns an annual rate of 5%. Photo illustration of a blue calculator in the center of the image, with blue jars. See how much your money could grow based on today's top savings account. But One Million Dollars in the Bank got my wheels turning. Mike's book This book might interest the reader who is new to motivational reading and starting new. What is the Annual Interest on 1 Million Dollars? With a 5% interest CD (Certificate of Deposit), your annual interest earned on $1 million would be $50, **Bank Sweep program balances are held at one or more Program Banks and are not cash balances held by Vanguard Brokerage Services® (VBS®), earn a variable rate. A 1-year CD is currently available at rates of around %, so if you invested $1 million at that rate, you would earn $58, after 12 months. The downside of. After 10 years you'd have $13, You'd earn $3, in interest. After 20 years you'd have $18, You'd earn $8, in interest. Use. Use the Dollar Bank interest calculator to help you develop a savings plan that will meet your goals. Enter a dollar value of an investment at the outset. Input a starting year and an end year. Enter an annual interest rate and an annual rate of inflation. Click. It depends entirely on the interest rate that is paid on the million dollars. If the million dollars earns an annual rate of 5%.

A $1 million investment can earn interest from $33, per year invested in US Treasury bonds to around $ million invested in real estate after a ten-year. $60, - $ million. Purchase price. Input range $60, - $ million No more than three Fixed-Rate Loan Options may be open at one time. Rates. This means that, if you open a NDC Account, you will be able to withdraw your funds only in U.S. dollars. For accounts eligible for the 1-year. Assuming a conservative average interest rate of 1% per year, a $1 million dollar investment in a high-yield savings account or a Certificate of Deposit (CD). How much money you need to live off interest depends on your spending, interest rates, and inflation estimates. Most Americans need over $1 million. What is the Annual Interest on 1 Million Dollars? With a 5% interest CD (Certificate of Deposit), your annual interest earned on $1 million would be $50, Of course, an extra $ doesn't sound like much, but at the end of 10 years, your $1, would grow to $1, with compound interest. The 1% interest rate. Or, about $15, after a decade. So if you want to know “How much interest will I earn on $1 million?” well, in a bank account it will be modest. Banks and credit unions tend to offer lower rates than online lenders. However, they also make it more difficult to obtain financing. Certain loan products. Bankrate's picks for the top jumbo money market rates · First Internet Bank – % APY, $1,, minimum balance for APY · America First Credit Union – million dollars in savings. It Savings Calculator: How Much Could You Save? 6 Types Of Savings Accounts · Capital One Savings Account Interest Rates. At the time of writing, term deposit interest rates are reaching 5%pa (per year) in some cases. With a deposit of $1 million, you could earn about $50, in. If you invested in a CD (Certificate of Deposit) and earned 5% interest on $ million dollars, you would earn a daily pre-tax amount of $13, per day. If. i have k in a bank account, it pays % and it pays out monthly. Every month at the end of the month I get about $ added to the amount. Step 1: Initial Investment. Initial Investment. Amount of money that you have available to invest initially. Save A Million Dollars Calculator. Calculate your earnings Checking Accounts · 1 year CDs · Money Market Accounts · 5 year CDs · High Interest Savings. Relationship rates available. Earn a Relationship Interest Rate 1 when you link your Platinum Savings account to an eligible checking account. Flexible access. What do you need to do to save one million dollars? Bread Savings' save a million calculator helps you find out. Enter your current savings plan to find out. Another is to invest the money in a standard portfolio, typically one And in a low interest rate environment, annuities are going to have less. The “national rate cap” is calculated as the higher of: (1) the national rate plus 75 basis points; or (2) percent of the current yield on similar maturity.

1 2 3 4 5 6